Spouse bad credit mortgage

Pre-qualify for your personal loan today. The borrower doesnt make any loan payments on a reverse mortgage.

Va Mortgages And Credit When Your Spouse Has Bad Credit

A government-backed VA loan might be an option for you if youre a veteran or qualified servicemember or spouse.

. And if your application is initially rejected be sure to call the card issuer and ask for reconsideration. We welcome your comments about this publication and your suggestions for future editions. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

September 16 2022 Tonight. The term reverse mortgage usually refers to a Home Equity Conversion Mortgage HECM. Compare personal loans from online lenders like SoFi Marcus and LendingClub.

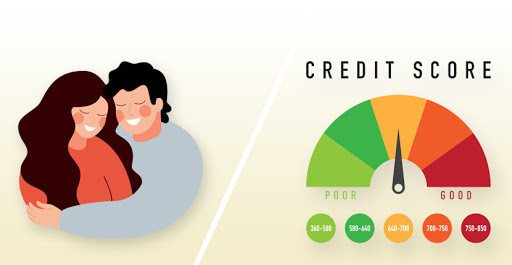

Credit scoring firm FICO defines Fair credit as scores from 669 to 580 with anything below designated as Poor credit. Credit union personal loans may have lower loan limits than youll find from other lenders often 50000 or less. The Over Age 65 Circuit Breaker Credit is an additional benefit for taxpayers over the age of 65.

ø Results will vary. When you and your spouse apply for a mortgage together your lender will only consider the lowest middle score between you and your spouse. The credit line option.

Fannie Mae HomePath. Learn More about Premier. Best for large purchases.

Up-front mortgage insurance premium. Most credit will ultimately warrant an approval on a refinance purchases are a little more strict but if your credit. Know where you stand with access to your 3-bureau credit scores and report.

But Consumers Credit Union allows eligible borrowers to take out as much as 100000 with its signature loan. A lender will consider the combined credit scores of both spouses or use the lower credit score applying for a loan. If you have FICO credit scores of 740 750 and 760 but your spouse has scores of 620 580 and 640 your lender will only consider your spouses 620 score.

Based on property value and may vary by lender. Uncover potential fraud with credit monitoring and alerts. You must be over the age of 65 be an Indiana resident with a standard homestead on file and the assessed value of the home may.

NW IR-6526 Washington DC 20224. Not paying your spouses debts will not affect your credit score. Dont forget to include your spouses age even if they are not yet 62 as loan proceeds are always based on the age of the youngest spouse.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. If one spouse has good credit and the other has poor credit or one spouse doesnt meet the lenders income requirements they may not qualify for a loan or only qualify for a loan with a less favorable interest rate. Why Consumers Credit Union stands out.

To determine which personal loans are the best for consumers with bad credit Select analyzed dozens of US. Take control with a one-stop credit monitoring and identity theft protection solution from Equifax. Reverse Mortgage After The Death Of A Spouse.

You can still get a reverse mortgage with bad credit depending on the credit. Homeowner Tax Deductions. Reverse Mortgage Line of Credit.

Anyone who is considering applying for a home mortgage should wait. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. Theres no industry-set minimum credit score to buy a house but Rocket Mortgage requires a credit score of at.

VA-guaranteed loans are available for homes for your occupancy or a spouse andor dependent for active duty service members. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. But one lenders definition of bad or subprime credit can be very different than anothers.

Credit score calculated based on FICO Score 8 model. Boosting a bad credit score in the 300 579 range is possible through on-time payments and keeping a low balance with one of these cards. Rates start as low as 5 for qualified borrowers.

The enhanced credit amount begins to phase out where modified adjusted gross income exceeds 150000 in the case of a joint return or surviving spouse 112500 in the case of a head of household and 75000 in all other casesIf you or your spouse if filing jointly lived in the United States for more than half the year the child tax credit. The best credit cards for bad credit have minimal requirements to qualify or are secured cards require an initial deposit making them accessible to almost anyone. However there are exceptions to be aware of.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. A HECM is a type of loan available to homeowners who are at least 62 years old and who own their homes outright. To be eligible you must have satisfactory credit sufficient income to meet the expected monthly obligations and a valid Certificate of Eligibility COE.

The loan is secured on the borrowers property through a process. Alimony payments and the income of your spouse or domestic partner if it can be used to pay the credit card account. Through a Wells Fargo Home Mortgage refinancing loan you may be able to pay off your mortgage sooner cut your higher interest rate lower your monthly payments or convert to a fixed mortgage rate.

The bank identifies the median score for both. A mortgage in itself is not a debt it is the lenders security for a debt. Typical Reverse Mortgage Closing Costs.

Personal loans offered by both online and brick-and-mortar banks including large. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them. Generally speaking a spouses debt should not impact your credit score.

The reality is there isnt one credit score or credit scoring model. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether. 2 days agoSeptember 16 2022 Mortgage deductions are going away but its not all bad news.

Not all payments are boost-eligible. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The banks loan officer group offers home equity loans and home equity lines of credit based on the value of your home compared to your existing mortgage balance.

Your Guide To 2015 US. And if you are applying for a mortgage with another person such as your spouse or partner each applicants FICO 2 4 and 5 scores are pulled. Purchase Loans and Cash-Out Refinance.

Help monitor your credit and Social Security number.

How To Get A Bad Credit Home Loan Lendingtree

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Will The Credit Score Of Your Spouse Affect You After Marriage

When Applying For A Home Loan Does Your Spouse S Credit Matter Intercap Lending

Are You Saying I Do To Your Spouse S Bad Credit

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Home Loan In Community Property States Mortgage Guidelines

Can I Apply For A Mortgage Without My Spouse

Pros And Cons Of Applying For A Mortgage Without Your Spouse

Buying A House Without Your Spouse Community Property Edition Quicken Loans

Getting A Mortgage When Your Spouse Has Bad Credit

What Is A Non Purchasing Spouse

Am I Responsible For My Spouse S Credit Card Debt

Help My Spouse Partner Has Bad Credit Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Ttrrgabacalxzm

Getting A Mortgage With Bad Credit Options For Military Home Buyers Pcsgrades

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila